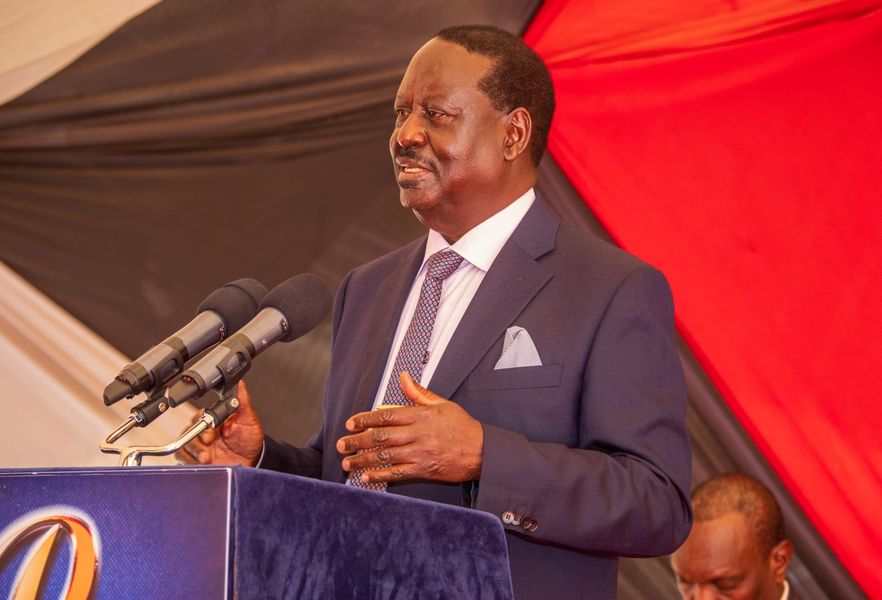

Azimio Statement On Finance Bill 2023-2024

The Finance Bill prepared by the Kenya Kwanza Regime spelling out how they want to raise money in the 2023-2024 Financial Year is a piece of punishment that Kenyans should be deeply concerned about.We are shocked that anybody living in Kenya and who understands and appreciates what Kenyans are going through can come up with the taxation proposals the bill is making. It is even more shocking that a regime that rode to office promising to lessen the burden of the so-called hustlers, mama mboga, watu wa mjengo, can turn its back so soon on the people.

The tsunami of taxes in that bill will bury everyone, especially the jobless youth and the poor struggling down at the bottom. The Bill is a promissory note to strangle and suffocate the hustlers that Ruto promised to remove the rope from their necks.We wish to make it clear from the outset that as a party, we will try our best to ensure that this anti-people budget is not passed by the National Assembly.

In the event that Kenya Kwanza uses its hired majority and passes the Bill as it is, we want the people of Kenya to understand that it is Kenya Kwanza’s Bill. It is Kenya Kwanza budget. It will be Kenya Kwanza strangling them. We will instruct our MPs to have nothing to do with it.

The mischief is hidden everywhere across the Bill, but we will highlight a few:TURNOVER TAX: Currently, turnover tax, that is tax based on sales, is applicable on sales worth Ksh1 million and above and it stands at one per cent. Now, Kenya Kwanza wants this tax applied on sales worth Ksh500, 000 and raise the tax rate from 1 per cent to 3 per cent. The taxation will be pegged on gross sales, whether the seller makes profit or not.The biggest casualties here will be small and medium sized businesses. Those businesses are the heart of the hustler nation. They are struggling.

The same businesses are already by counties, bogged down with a number of requirements for permits and licenses. Our stand is that this tax should remain at 1 per cent and should be applicable sales of Ksh1 million and above.INCOME TAX ADJUSTMENT: If you look at a pay slip of a typical employee in Kenya whether in the public or private sector; you will be hit by four things: there has been no pay increase in the last five or more years; at least a quarter, sometimes up to half of the salary is consumed by taxes; much of the salary is consumed by all sorts of loans, much of the salary goes into funding dead institutions like NSSF and NHIF, which in the end do not serve the needs of the employee.

Now, unilaterally, Kenya Kwanza wants to raise taxes from the current 30 per cent to 35 per cent on those earning Ksh500, 000 and above. The shock will be felt down the chain. Direct taxation as a means of raising money usually has unintended consequences. Typically, a single pay slip supports entire villages and communities in Kenya. As Kenya Kwanza reduces availability of local disposable income, it is inadvertently reducing local demand for goods and services.

It leads to more unemployment and more desperation. We will be instructing our MPs to oppose this proposal.HOUSING FUND: Unilaterally, Kenya Kwanza wants to deduct 3 per cent of basic salaries to finance affordable housing scheme. How the regime arrived at 3 per cent and not one or two, nobody knows. In an economy where employees are already faced with reduced income due to high cost of goods, we find the introduction of this new tax irrational. It further reduces the amount of disposable income available to the economy. We find it curious that while not everyone is qualifies the proposed affordable housing regime, everyone is expected to pay. This is illegal borrowing.

According to the Bill, those who do not qualify for the affordable houses will have their monies refunded or transferred to beneficiaries, after seven years. There is no mention of interest accrued on the money. It is not clear why an employee who does not need a house would have his or her money tied up in a housing scheme when he or she would wish to spend it on farming or just feeding family.

There is also no guarantee that the housing scheme will work where schemes like NSSF and NHIF have been crippled by corruption.ATTACK ON DITIGITAL ECONOMY: After being attacked through turnover tax, the youth who have tried to find themselves jobs by using their creative talents in the digital space are being targeted through digital content monetization. From paying zero tax currently, a creative youth who creates a digital platform or content will be required to pay 15 per cent tax. As a country, we will be killing innovation and leaving our youth with too few options, if any.

We will not support this proposal.TAX APPEALS TRIBUNAL: A proposal is being made that in the event a business or an individual happens to have a dispute with the Kenya Revenue Authority over taxes owed, that individual or company will be required to deposit 20 per cent of the disputed amount with KRA before the matter can be heard by the Tax Appeals Tribunal. This is another aspect of illegal borrowing by the regime. It is open to abuse rogue KRA. It will affect cash flow of companies.

We oppose it.TAXATION OF RIEMBURSMENTS (PER DIEM): Out of the blues, Kenya Kwanza wants to tax money paid to officers on duty at 30 per cent. How then do those officers meet their expenses? Since when did reimbursement get to be treated as income? We find this requirement extremely punitive. We oppose it.TAXING TRADE ASSOCIATIONS: After taxing traders, Kenya Kwanza want to follow them and tax their associations. Associations whose duty is to fight for the welfare of members will now be deemed to be carrying out business and be taxed on gross receipts which will be deemed as income. This is double jeopardy that will affect the welfare of businesses in the country. We oppose it.ENHANCED VAT PAYMENTS: Buried in this Bill are proposals to remove from zero-rating to tax-exempt pharmaceutical products, agricultural pest products and even fertilizers. Maize flour, cassava flour and a number of other types of flours are being moved from zero-rating.

Transportation of sugarcane to factories will now attract VAT. The VAT measures proposed by the Bill effectively raise the cost of medicines, healthcare and food, including that of locally produced sugar. It goes against Kenya Kwanza’s often stated pledge to subsidize production. We object.ENHANCED EXCISE DUTY ON IMPORTED CEMENT: Kenya Kwanza wants to raise duty on imported cement. It will be a signal for local producers to raise their prices. This will impact the local construction industry which is currently the main driver for job creation in Kenya.TAX ON BEAUTY PRODUCTS: Beauty products such as wigs, false beards, eyelashes, human hair, artificial nails, among others, will see their taxes rise from Sh0.6 to Sh2.5 per stamp.

This is a 316 percent hike. Like digital economy, the beauty industry has become a major employer particularly for our youth and women who have been unable to find work elsewhere. It is a home to hustlers. Now Kenya Kwanza is going after their earnings. Kenya Kwanza wants to treat beauty as a luxury. We disagree.LADIES AND GENTLEMEN;Kenyans cannot be taxed to the bone just because of Kenya Kwanza’s internal weaknesses.

Rather than increase taxes, the regime must undertake the following:An immediate stoppage of non-essential government expenditures including stoppage of the appointment of Chief Administrative Secretaries.Reduction in size of government. Excess cabinet secretaries, principal secretaries, directorates, advisors, aides, departments and CASs are gobbling up finances for no good value for money.Kenya Kwanza must completely abolish money being spent on political operations that are disguised as relief food distribution or fundraisers. It makes no sense at all for a Cabinet secretary or a principal secretary to spend Ksh20 million on a chopper to distribute 1 million worth of food. That is a job a chief or assistant chief or even MCA can do. It makes no sense for a principal secretary to spend Ksh10 million on a chopper to deliver Ksh200, 000 on a fundraiser. This madness must stop in the interest of austerity.Domestic and international travel, conferences and workshops, training must be reduced. We need a freeze on ministerial out of station allowances, ministerial house allowances and domestic allowance for cabinet and principal secretaries.Kenya Kwanza must end corruption and theft of public funds.Kenyans can’t and won’t tighten their belts any further. They have had enough. Their next available course of action is to force Kenya Kwanza to tighten its belt or force it out.