Central Bank of Kenya Report Reveals Stark Variations in Bank Lending Rates

A new report from the Central Bank of Kenya has highlighted significant disparities in the interest rates charged by banks on loans, reflecting a wide range of costs for borrowers across the market.

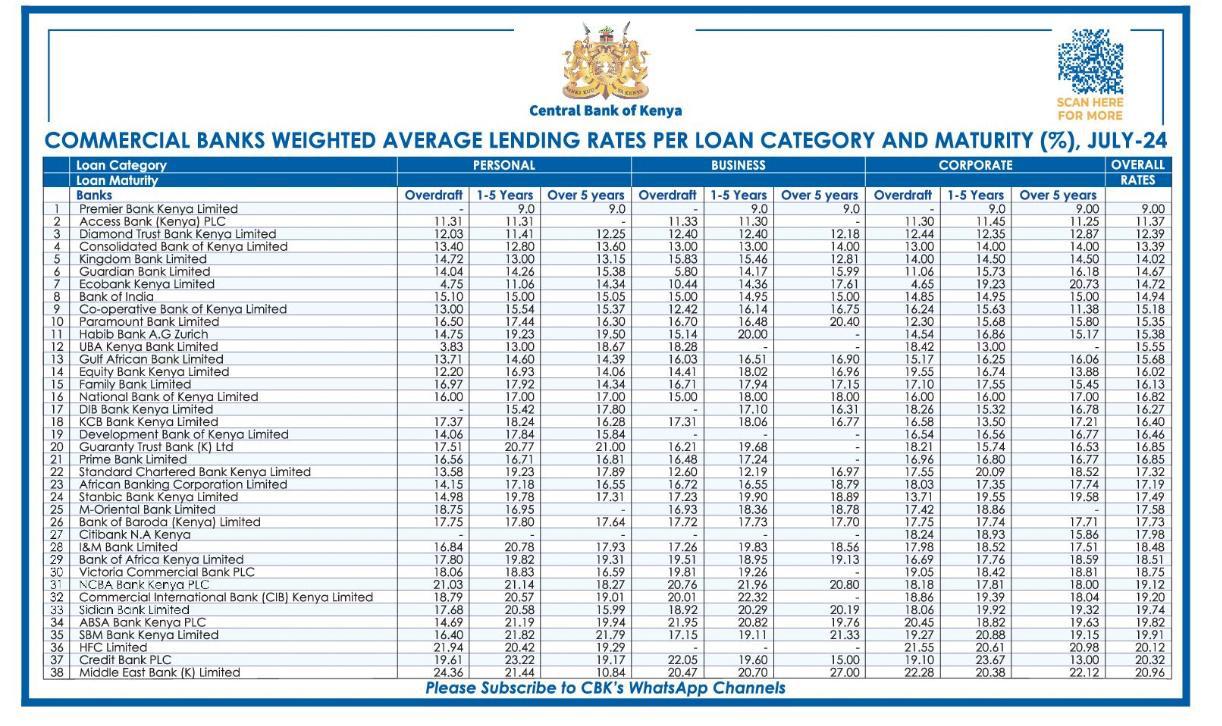

The findings underscore a marked difference in lending rates, with some banks offering rates below 10 percent, while others charge as high as 24 percent per annum.

According to the report, Cooperative Bank offers the lowest lending rate among Tier One banks, with an overall rate of 15.18 percent. This positions Cooperative Bank as a relatively affordable option for borrowers within this segment.

In contrast, Premier Bank and Access Bank stand out for their competitive rates, with Premier Bank offering the most economical rate at 9 percent per annum, and Access Bank following closely with a rate of 11.15 percent per annum. These rates reflect the most favorable terms available to consumers according to the report.

At the other end of the spectrum, Middle East Bank emerges as the highest-cost lender, with an overall lending rate of 20.96 percent. This rate highlights the significant cost that borrowers could face when choosing to take loans from this institution.

The report’s findings reveal not only the broad spectrum of loan costs in the Kenyan banking sector but also point to the critical role of rate comparison for consumers seeking the best terms for their borrowing needs.

As the lending landscape continues to evolve, these insights provide valuable guidance for individuals and businesses looking to navigate the complexities of bank loans.