KRA Delegation Visits TENP to Strengthen Partnership and Promote Tax Compliance

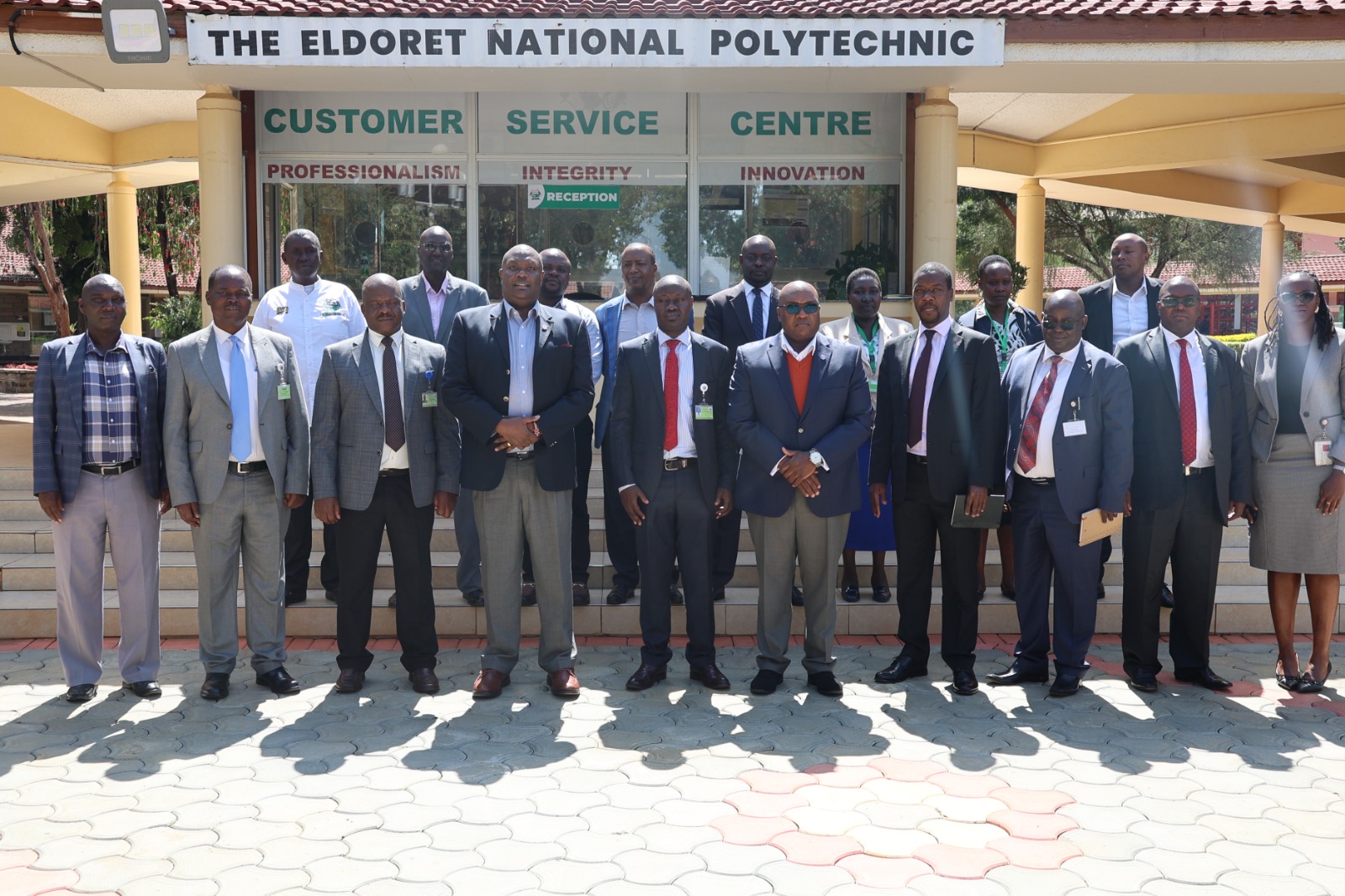

A high-level delegation from the Kenya Revenue Authority (KRA), led by Commissioner Richard Boro Ndungu, visited the Eldoret National Polytechnic (TENP) on 5th November 2024 to explore further opportunities for collaboration and acknowledge the institution’s contribution to tax compliance and revenue collection. The delegation, which also included members of the KRA Board, was welcomed by TENP’s top management, headed by Chief Principal Dr. Charles Koech.

The visit underscored the growing importance of collaboration between the KRA and key educational institutions like TENP, particularly in the areas of tax compliance, public awareness, and capacity building. In his address, Commissioner Ndungu praised TENP for its exemplary efforts in tax compliance, emphasizing the critical role that educational institutions play in fostering a culture of tax responsibility. He commended the institution for consistently contributing to national revenue collection and adhering to tax obligations. “TENP stands as a model institution in maintaining tax compliance. The KRA values such partnerships and will continue to explore avenues for further collaboration to strengthen Kenya’s revenue collection framework,” Ndungu remarked.

Dr. Charles Koech, the Chief Principal of TENP, expressed his gratitude to the KRA team for visiting the institution and reiterated the institution’s ongoing commitment to remaining fully tax compliant. He noted that TENP was dedicated to nurturing responsible citizens who understand the importance of tax compliance. “We recognize the critical role that taxes play in national development, and we assure you that TENP will continue to uphold the highest standards of tax compliance. Additionally, we are open to enhancing our partnership with KRA, particularly in areas such as tax education and training,” Dr. Koech said.

A key moment during the visit was the presentation of a Certificate of Appreciation to TENP by the KRA delegation. The certificate, which recognizes TENP’s significant contribution to revenue collection and its role as a tax-compliant institution, was received by Dr. Koech on behalf of the entire institution. The KRA’s gesture highlighted TENP’s pivotal role in supporting the country’s revenue goals and its active participation in upholding the tax framework that funds national development projects and public services.

In addition to discussions on collaboration and partnership, the KRA team participated in a tree planting exercise at the institution’s grounds. More than 30 trees were planted by members of the KRA delegation, TENP staff, and students, as part of the national tree planting initiative. The event was seen as a symbolic gesture of environmental stewardship and sustainability, aligning with both KRA and TENP’s commitment to contributing positively to the country’s ecological efforts. The trees were planted to support the ongoing national campaign to combat deforestation and promote environmental conservation.

The tree planting event also served as an opportunity to engage students and staff in the broader discussions around national responsibilities, with KRA officials highlighting the connection between environmental sustainability and responsible citizenship, including the role taxes play in funding such initiatives. The event was well-received by the TENP community, who appreciated the hands-on involvement in supporting Kenya’s environmental goals.

Mr. Ndungu’s delegation took time to tour various facilities at TENP, learning more about the institution’s programs, its student engagement initiatives, and its efforts to produce skilled graduates who can contribute meaningfully to the economy. Both parties discussed future areas of collaboration, especially in developing curriculum and training programs that promote financial literacy, tax compliance, and an understanding of national revenue systems among students.

The KRA’s visit to TENP comes at a crucial time, as the authority continues to explore innovative ways of enhancing taxpayer education and improving the ease of tax compliance. The discussions between KRA and TENP have set the stage for a deeper partnership, with both parties expressing a shared commitment to driving sustainable development through collaboration in the fields of education, revenue collection, and environmental responsibility.