I&M Group PLC Reports 24% Growth in Profit Before Tax for Q3 2024

I&M Group PLC has posted a 24% increase in Profit Before Tax (PBT) for the third quarter of 2024, reaching KES 14.1 billion, compared to KES 11.4 billion in the same period of 2023. This impressive growth highlights the Group’s robust financial performance, underpinned by strategic investments and a strong focus on customer-centric solutions.

The Group’s operating revenue surged by 20%, while operating profit increased by 24%, totaling KES 18.9 billion. Notably, Net Interest Income saw a significant rise of 37%, reflecting the Group’s efficient management of its earnings assets portfolio. Despite this, loan loss provisions rose to KES 5.5 billion, up from KES 4.6 billion in 2023, as the Group remains vigilant about asset quality.

Operating expenses, excluding loan loss provisions, climbed by 16%, driven by investments in technology, talent, and branch expansion efforts in Kenya and Rwanda. The Group’s total assets grew by 4% to KES 568 billion, while customer deposits increased by 3%, reaching KES 414 billion, bolstered by the Group’s innovative product offerings and ongoing digitization efforts.

The Group’s regional subsidiaries also contributed to the strong results, accounting for 28% of the total PBT. This growth was fueled by substantial gains in operating income, driven by a 49% increase in corporate and institutional banking and a 28% growth in retail banking.

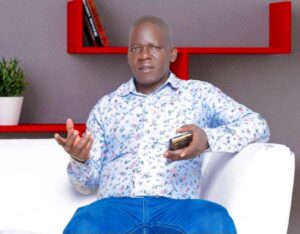

Commenting on the results, Mr. Kihara Maina, Regional CEO of I&M Group PLC, attributed the Group’s success to its strategic focus on digital transformation and operational efficiency. “The 24% increase in profitability is a testament to the strong start of our iMara 3.0 strategy,” Maina said. “Based on this performance, the Board of Directors has announced an interim dividend of KES 1.30 per share, to be paid in January 2025. As we celebrate I&M Bank’s 50th anniversary, we remain committed to customer centricity and digital transformation to ensure sustainable profitability in the years to come.”

I&M Bank Kenya, the Group’s flagship subsidiary, reported a 21% increase in PBT, driven primarily by growth in Net Interest Income. The Bank also recorded a 19% year-on-year increase in revenue and a 17% rise in operating profit. A key highlight was the 36% year-on-year growth in its customer base, largely driven by the success of its ‘Ni Sare’ free bank-to-M-PESA and Airtel Money proposition, which was extended to SMEs in April 2024. This initiative has resulted in a 270% increase in SME customer acquisition in Kenya.

“Through our customer-centric approach, we have positioned I&M Bank as one of the fastest-growing banks by customer numbers in the region,” said Mr. Gul Khan, CEO of I&M Bank Kenya. “Our efforts in bridging the financing gap for SMEs and MSMEs have played a critical role in this growth, as has our focus on brand relevance, which has led to a 14% improvement in brand awareness.”

Regionally, I&M Group saw strong performances across its subsidiaries. I&M Bank Rwanda posted a 55% increase in PBT, driven by increased loans and deposits, while I&M Bank Tanzania achieved a 73% rise in operating profit. I&M Bank Uganda reported a 37% increase in operating profit, and Bank One, Mauritius, showed resilience with a 16% increase in operating income.

As part of its ongoing efforts to drive digital innovation, I&M Group reported that 83% of its customers across the region are now digitally active, demonstrating the success of its digital accessibility initiatives.

In conclusion, I&M Group’s consistent growth in profitability, supported by a robust strategy and strong regional performance, positions the Group for continued success. As it celebrates 50 years of service, the Group remains focused on sustainable growth and creating value for its stakeholders.