Former MP Calls for Stringent Measures to Regulate Digital Lenders, As Aviation Sector Pleads for Review of Proposed Taxation

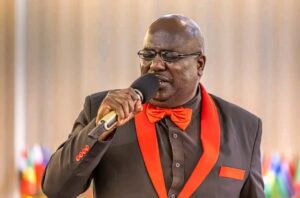

Former legislator Hon. Lewis Nguyai has called for stronger regulations to curb the predatory practices of digital lenders, especially those targeting borrowers unable to access traditional bank loans. Speaking before the Departmental Committee on Finance and National Planning, Nguyai highlighted the rising cases of borrowers falling prey to exorbitant interest rates and unconscionable lending terms from digital lenders.

Nguyai’s comments came during his submission on the Business Laws (Amendment) Bill, 2024. He expressed concern over the growing number of unregulated non-deposit taking microfinance institutions, urging lawmakers to introduce stringent measures to protect consumers. “The Constitution guarantees the right to privacy, property, and consumer rights. However, many borrowers face unfair lending practices that leave them vulnerable to arbitrary debt recovery and loss of property,” Nguyai said.

He called for a mandate requiring digital lenders to fully disclose all terms and charges associated with loans before disbursement, ensuring that borrowers are fully informed of the consequences of their financial agreements. Nguyai further proposed amendments to the Bill, which would subject debt recovery processes to the Civil Procedure Act and protect borrowers’ privacy in line with the Constitution and the Data Protection Act.

The proposal received widespread support from legislators. Kigumo MP Hon. Joseph Munyoro welcomed the suggestion, emphasizing the importance of regulating rogue digital lenders. “We need to ensure that digital lending practices are anchored in law to protect the most vulnerable borrowers,” he stated. Butula MP Joseph Oyula also expressed support, noting that the reforms would benefit people in the informal sector, including those in the boda boda industry, by providing them access to fair lending terms. Committee Vice-Chairperson Hon. Benjamin Langat echoed these sentiments, stressing the need to protect individuals from exploitative lending practices in the digital space.

Meanwhile, stakeholders from Kenya’s aviation sector have raised concerns over the proposed introduction of a 16% Value Added Tax (VAT) on various services, including air ticketing, aircraft maintenance, and tourism-related services. The Kenya Association of Travel Agents (KATA) warned that the move would increase travel costs and negatively impact the tourism industry, a key sector in Kenya’s economy.

KATA argued that imposing VAT on air ticketing services would increase operating costs for travel agents and affect both domestic and international tourism. They urged the Committee to retain the current VAT exemptions on air ticketing, warning that Kenya’s tourism sector would face increased competition from other African countries offering preferential tax rates.

The International Air Transport Association (IATA) also supported the proposal to keep air transport services VAT-exempt, highlighting that it would stimulate growth in domestic and regional travel, boost revenue collection for the Kenya Revenue Authority (KRA), and attract more investors to the aviation industry.

The Committee’s hearings are set to continue tomorrow, as both sectors await further deliberations on these crucial legislative matters.